Is it flood or is it not?

One of the most confusing areas of a homeowner’s insurance policy has to do with covering water damage. Is it covered or excluded???

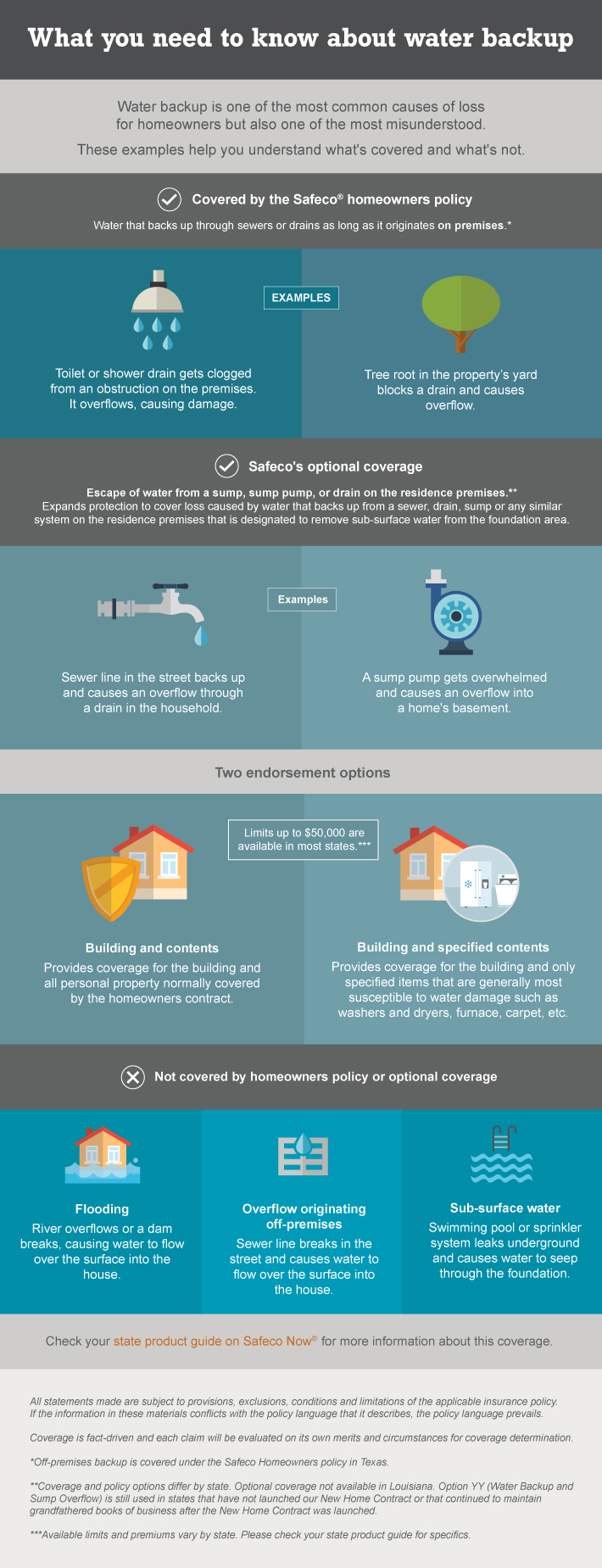

No traditional homeowner’s policy offers any protection for flood insurance yet there is protection for water damage but it depends on the cause. Without over-simplifying it, if water is purposely brought into the home (ie. plumbing) then any resulting damage is typically covered. If a pipe freezes or your water heater leaks and damages your carpet, for example, most homeowner’s policies cover this. It’s important to keep in mind, insurance usually covers the cost to repair the damages only. Suppose your water heater tank leaks and ruins your kitchen floor. Your policy will cover the cost to replace your kitchen floor, but not necessarily the cost of a brand new water heater.

Sump pump failure

A similar optional coverage for homeowner’s is called “water & sewer drain backup“. There are some instances, say, if you have a finished basement below grade, you might be concerned with a drain clog or a failing sump pump leaving you exposed to water damage. This coverage can be selected to protect your home against such a loss.

Other situations might involve an indirect cause. Let’s say a tornado rips your roof off and rain gets in and causes damage. Since wind is usually considered a covered peril, then the resulting damage caused by rain would also be covered.

Now, let’s take a look at when water damage isn’t covered. If a nearby river or lake floods and water leaks into your yard and eventually into your home, that is considered a flood. Since most homeowner’s policies don’t cover flood, it must be purchased as a separate policy. The premiums vary depending on which flood zone your property falls in.

As always, you should check your own policy to see what exactly is covered and not covered. If you would like to review your current policy with us to make sure you are properly covered, call us or send us a message and we would be happy to schedule a time to go over everything with you.